Diesel sales back ahead of electric ones in July

Diesel sales back ahead of electric ones in July. In the wake of a global health crisis that disrupted industries acress the board, the European automotive market has emerged as a beacon of resilience and recovery. This text delves into the persistent phenomenon of the European automobile market’s resurgence, examining the nuanced dynamics that have shaped itd trajectrory. With data from the ACEA revealing a twelve-month streak of growth. This narrative unfolds against the backdrop of shifting consumer preferences.

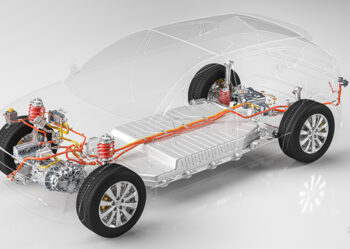

The impact of the energy transition, and the challenges faced by the industry. From the revival of diesel cars to the ascent of electric vehicles the market is navigating a complex landscape marked by both opportunities and obstacle. Exploration encompasses not only sales figures but also the broader transformation of how Europeans perceive mobility. As the automotive sector stands at a critical crossroads, European manufacturers are investing in cleaner technologies, navigating a landscape of increasing international competition.

Against this backdrop, the text concludes by underlining the crucial role of the industry’s adaptability and innovation in providing sustainable mobility solutions for the future.

The Recovery of the European Automobile Market: A Persistent Phenomenon

The European automotive sector continues to show signs of a strong recovery. With a twelfth consecutive month of growth recorded in July, according to data provided by the European Automobile Manufacturers’ Association (ACEA). In the past month alone, no less than 851,156 units were sold in the European Union, marking a remarkable increase of 15.2%. This upward trend was particularly evident in the four major European automotive markets, with growth of 19.9% in France, 18.1% in Germany, 10.7% in Spain, and 8.7% in Italy.

Beyond this positive monthly report, the first seven months of the year also witnessed significant growth of 17.6%, with a total of 6.3 million new vehicles sold. However, it is worth noting that this figure is still 22% below the same period in 2019, before the outbreak of the Covid-19 pandemic. Nevertheless, ACEA considers that the automotive industry is showing signs of recovery, even after the significant disruptions caused by the pandemic.

The European Automotive Sector Bounces Back After Pandemic Challenges

The European automotive market has found a sustainable path to growth since August 2022. After facing severe disruptions due to the health crisis, exacerbated by a shortage of essential components, especially electronic components. This combination of factors had a significant impact on the European automotive industry, hindering production and leading to substantial delays.

A Shift in Dynamics: The Return of Diesel Cars

A noteworthy aspect of this recovery is that the market share of diesel vehicles surpassed that of electric vehicles in July, even though the latter recorded a rapid growth of 60.6%, with 115,971 units sold. However, electric vehicles now represent 13.6% of the market, trailing behind gasoline with a share of 35.8% and diesel with 14.1%. While it may not be a complete reversal of the trend (diesel still accounted for over 30% of sales in 2020), it marks a shift from June when electric car sales had surpassed diesel car sales for the first time in history. Overall, this likely reflects that electric vehicle sales are reaching a plateau at around 13-14% of the market.

Sales by Fuel Type

Between January and July, gasoline remains the preferred fuel for European buyers, with approximately 2.3 million gasoline cars sold, representing a 14% increase compared to the previous year. However, diesel car sales, though slightly down by 3%, totaled 910,000 units. Electric cars, despite their spectacular growth, still have a way to go to compete with traditional engines, with 820,000 units sold during the period, marking a 55% increase. Hybrids, on the other hand, reached 1.6 million sales (+29%). While plug-in hybrids, those that can be charged through a socket or charging station, totaled 468,000 units (+2%).

Performance of Brands in the European Market

Concerning brands and manufacturers, Tesla recorded the highest growth in July, with nearly 14,000 cars sold, representing an impressive increase of 650%. However, Tesla still lags behind industry giants like Volkswagen, which sold 233,000 units in July. Stellantis has sold 144,000 vehicles, albeit with a slight decrease of 6.1%. The Renault Group also saw significant growth of 17%, with 90,000 registrations.

Diversification of Transportation Modes

The evolution of the European automotive market is not limited to sales figures alone. It is also influenced by a radical change in how people perceive mobility. The emergence of carpooling services, vehicle sharing, and alternative mobility solutions has redefined how Europeans get around. Diesel is supposed to be forgotten and electric is the new “trend”. These alternatives offer increased flexibility to consumers seeking more economical and sustainable transportation options. The trend toward diversified transportation modes presents both challenges and opportunities for the traditional automotive industry.

Impact of the Energy Transition

The transition toward more environmentally friendly mobility is a major driver of the European automotive market’s evolution. EU governments and lawmakers are imposing increasingly strict regulations on greenhouse gas emissions and noise pollution. Prompting automotive manufacturers to invest heavily in cleaner technologies, including electric and hydrogen vehicles. This shift toward cleaner fuels and technologies undeniably influences consumer choices and shapes the market.

Electrification: A Growing Market

Although electric cars represent a relatively small share of the overall market, their ascent is remarkable. Technological advancements, government incentives, and growing awareness of environmental impact have propelled automotive electrification. However, challenges remain, including charging infrastructure, high costs, and limited range. All of which need to be addressed for electric vehicles to become a viable option for a larger number of consumers.

The Role of European Manufacturers

European automakers play a central role in the market’s evolution. They are investing heavily in research and development of advanced technologies to meet increasing emissions and safety requirements. Furthermore, they are seeking to strengthen their position in the global market by developing cutting-edge electric vehicles and exploring new overseas markets. International competition is intensifying, with Asian and American automakers seeking to establish themselves in the European market.

Challenges Facing the European Automotive Industry

Finally, the European automotive industry faces a range of challenges. Scarce raw materials, increased international competition, the management of complex supply chains. And the need to train and retrain the workforce to meet the changing needs of the industry. The pressure to reduce CO2 emissions and minimize impact also underscores the need to develop even more sustainable mobility solutions.

Conclusion: The Future of the Automotive Industry in Europe

In conclusion, the persistent recovery of the European automotive market after the challenges posed by the pandemic. The shortage of essential components is undeniably encouraging. The positive numbers recorded in recent months, indicate that the automotive industry is gradually bouncing back. However, despite these positive signs, the sector has not yet returned to its pre-pandemic activity level in 2019. As sales in the first half of 2023 were still 20% lower than those in the first half of 2019.

The market’s evolution, reflects the complexity of the ongoing transition toward more sustainable mobility. European manufacturers are making substantial investments in environmentally friendly technologies to meet strict emissions and noise pollution regulations. While facing increasing international competition.

Furthermore, the diversification of transportation modes and the impact of the energy transition pose challenges and opportunities for the automotive industry. Progress in electrification is impressive. Although obstacles remain to be overcome for electric vehicles to become a viable option for a larger number of consumers.

Ultimately, the European automotive industry stands at a critical crossroads. It must address significant challenges, from raw material scarcity to the management of complex supply chains. All while continuing to innovate and adapt to changing consumer needs and evolving environmental regulations. The industry’s future will depend on its ability to successfully navigate this changing landscape and provide more sustainable mobility solutions.

SNECI and Its Support

SNECI is specialized in business development and industrial performance improvement for over 70 years. We assist both SMEs, startups, and large corporations through various solutions and its dual expertise.

In industrial performance, we provide our clients with the means to achieve operational excellence by supporting them in their industrial projects or by training and coaching their teams. We also possess in-depth expertise in evaluating industrial companies and implementing best practices in quality, purchasing, and logistics.

In business development, our team partners with suppliers expanding into new regions. Seeking to acquire new customers, acting as an extension of their sales, project, quality, and logistics teams. We also advise companies on their partnership and acquisition strategies.

If you would like SNECI, with over 70 years of experience in the industry and 450 experts worldwide. Contact us directly through the contact tab on our website.