EV Battery: Automakers’ Hope and Challenge

Once the most boring and neglected of all automotive parts, the battery has become today a top priority and the main bottleneck for carmakers worldwide.

With the electric car market booming in this rather depressing year for automotive, carmakers found themselves short in innovative battery technologies. Promising a swift shift to the all-electric product range in the years to come, they fight to find the cheapest yet most performant and compact battery solution.

The development and production of this crucial EV component are concentrated in Asia. Yet, the urgent need for new technologies, followed by large R&D investments and inexistent local supply has pushed automotive players to sign partnerships to establish local battery development and production clusters. In the meantime, European, American, and Asian governments are injecting immense funds into battery technologies in pursuit of becoming a global leader.

However, both carmakers and governments are facing problems that won’t be easy to overcome in just a few years. Scaling the production of new battery technologies, like solid-state batteries, is difficult and may take a decade to realize. Moreover, a growing battery demand could increase prices for such scarce raw materials like lithium, cobalt, and nickel. Finally, governments will need to qualify more electrochemistry experts while dealing with the increasing unemployment rate among those specialized in the internal combustion engine.

The Rising Electric Car Battery Demand

Plug-in and electric vehicles accounted for 4.2% of global light-vehicle sales in 2020, a 41% rise compared to the previous year. In thirteen countries, all of which are European, the share of electrified vehicles (PHEV and BEV) in new passenger car sales was over 10%.

The European market for passenger cars and light utility vehicles contracted by 23.5% in 2020 compared to 2019 due to the Covid-19 crisis. Yet, the registrations of electrically-chargeable vehicles increased from 559,871 units in 2019 to close to 1.4 million (+144%) in 2020, including 745,684 BEVs (+107%) and 619,129 PHEVs (+210%).

Such surge in demand was largely driven by generous government incentives for low and zero-emission vehicles. In France, where a double bonus system has allowed consumers to receive a reimbursement of up to 12,000 euros since June 2020, the registrations of electrified vehicles have tripled, reaching 185,719 units last year.

A substantial increase in demand in an overall decreasing market has pushed automakers to review their strategies and speed up the electrification of their product range.

Groupe Renault, the market leader for electric vehicles in Europe, pledges to introduce ten new all-electric models (out of 24 in total) across its five brands in the next four years.

Stellantis has announced that it will offer 50% of its vehicles in electrified versions in 2021 and a full-electric range by 2025.

Volkswagen, which had tripled its deliveries of EVs last year, plans to invest over €11 billion in electric mobility by 2023 and produce 1.5 million electric cars a year by 2025.

BMW Group expects to double the sales of electrified models across the BMW and Mini brands by the end of 2021. The German manufacturer will launch at least 9 new pure-electric models to reach its ambitious goal to sell over seven million plug-in hybrid and pure-electric vehicles by the end of 2030.

Daimler promises to electrify the entire Mercedes-Benz Cars product range by 2022 and reduce the number of internal combustion engine (ICE) models it offers to 70% by 2030.

Volvo Cars aims for half of its global sales to consist of fully electric vehicles by 2025, with the rest being hybrids. By 2030, every car it sells will be full-electric and sold exclusively online.

Jaguar Land Rover is planning to make the Jaguar brand all-electric by 2025. The British automotive group will also launch the first all-electric Land Rover in 2024, followed by five more models within two years.

In this race to win consumers’ hearts and lead the European EV market, carmakers search for a battery solution that will provide the most autonomy at the lowest price and in the smallest package. A solution that doesn’t come easy.

Asia is Leading the EV Battery Production

Nearly 140 GWh of batteries were allocated to the electric and hybrid mobility sector worldwide in 2020.

LG Energy Solutions, CATL, Panasonic, BYD, Samsung SDI, and SK Innovations dominate battery manufacturing today. Most of these companies are based in China, Japan, or South Korea.

Market leader and the main supplier of batteries to European carmakers, LG Energy Solutions (LG Chem) alone represents nearly 40 GWh of battery volume produced. The South Korean manufacturer supplies to Tesla in China and has an extensive client portfolio in Europe, including VW, Renault, and Mercedes, among others.

The Chinese company CATL is in second place with around 30 GWh capacity. It principally supplies the regional industry.

Close behind comes 2019’s leader, Panasonic, Tesla’s partner and the top battery supplier to the USA. The Japanese producer hasn’t shown any growth in 2020 compared to other EV battery manufacturers that have posted significant gains.

Although Asia is clearly a pioneer in battery production today, new players are getting into the game, fueled by immense investments from European governments and leading automotive companies.

Europe to Create its Own EV Battery Supply

Indeed, battery manufacturing has vast geopolitical implications. EU auto industry does not want to depend too much on the imports from Asia overall and China in particular. In January 2021, the European Commission has approved €2.9 billion public support by twelve Member States for a second pan-European research and innovation project along the entire battery value chain. Tesla, BMW, FCA are amongst the top beneficiaries.

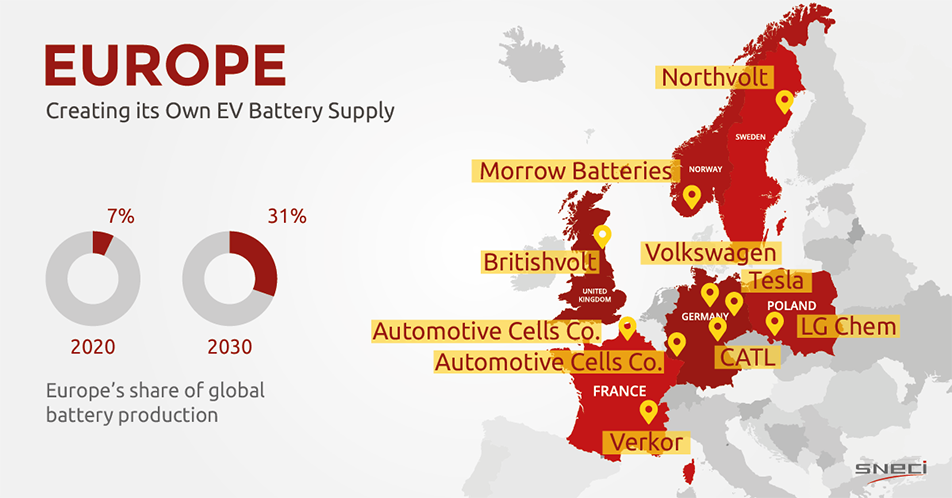

On top of that, the expansion of battery production in Europe is crucial for local carmakers as it brings control over the latest innovations and cost-reduction through shorter supply chains. According to BloombergNEF, Europe could see its share of global battery production rise from 7% in 2020 to 31% by 2030.

The last several years were marked by a few important partnerships in the field.

PSA Groupe has partnered with Total/Saft to create a joint-venture dedicated to the development and production of high-performance batteries for electric vehicles in Europe. Named Automotive Cells Co. (ACC), the company will receive over €5 billion investment from French and German public authorities to build two “gigafactories” in Douvrin (France) and Kaiserslautern (Germany). By 2030, the joint-venture plans to reach a cumulative capacity of 48 GWh, enough to supply 1 million EVs or 10% of the estimated European market.

VW and BMW have both invested in a Swedish start-up Northvolt. The company will establish the first homegrown “gigafactory” for lithium-ion battery cells in Sweden by 2021.

Volkswagen also plans to build six battery-cell factories in Europe by 2030 with a joined production capacity of up to 240 gigawatt-hours (GWh) a year (including the 40 GWh that will come from Sweden’s Northvolt).

Following Nothwolt’s success, Verkor was created to accelerate the production capacity of low-carbon batteries in southern Europe, mainly France, Italy, and Spain. Supported by Schneider Electric, the French start-up has scheduled to launch production in 2023 at its manufacturing site in France with an initial capacity of 16 GWh of battery cells.

Tesla, which is currently supplying batteries from Panasonic, has decided to move the production of batteries in-house to reduce the cost and make its EVs more affordable. It will also help the company to avoid further battery supply delays and ramp-up the vehicle production. Tesla plans to manufacture its brand-new structural battery pack in the “gigafactory” near Berlin alongside the Model Y.

The Problems

Concentrated on breaking the dependence on battery cells from Asia, European automakers and public authorities often ignore the fact that it is even more important to have access to crucial raw materials. The speed at which new mining projects are being opened isn’t keeping pace with demands from the growing electric mobility industry. This may result in supply bottlenecks and bring battery price levels significantly up, as raw materials account for 45% of lithium-ion battery cell cost. European EV battery manufacturers and carmakers have to secure their supply chains all the way to the mine to ensure their stability on the market.

The current lithium supply is oligopolistic in structure. Such companies as Albemarle (USA), SQM (Chile), Ganfeng Lithium (China), Tianqi Lithium (China), and Livent (USA) make up for more than 70% of the world’s lithium supply. Creating meaningful partnerships with these companies through joint ventures, direct investments, and long-term supply contracts is essential to dominating battery production.

Another hurdle for auto companies yet a key lever to reduce high battery cost is the mass production of battery cells. However, as Elon Musk, Tesla’s chief executive, said during the “battery day” in September 2020, mass-producing batteries is “the hardest thing in the world.” New production techniques, such as solid-state batteries that use solid layers of a lithium compound and are, therefore, more stable, recharge faster, and weigh less, will take several years to develop, test, and put in place.

Governments will also face difficulties during the reordering of the automotive industry in the upcoming years. Of course, massive investments into regional battery production will create many work opportunities. Tesla’s “gigafactory” in Berlin will employ up to 40,000 workers in 3 shifts, according to a German Minister of Economic Affairs, Labor and Energy Jörg Steinbach. The French start-up Verkor will create up to 2,000 jobs before 2023.

Nonetheless, the reorientation of the auto industry to electric mobility will also claim some victims, like the companies that build parts for internal combustion engine cars and trucks, increasing unemployment. Requalification of these workers may require even bigger public funds and a number of years to complete.

The rapid development of electric mobility brings a lot of excitement and hope to the industry. In the meantime, it creates challenges that have not been known before. One of them is finding the cheapest yet most performant and compact EV battery technology.

European automakers have pursued different strategies in battery development, production, and supply, creating joint ventures, relying on start-ups, or moving the production in-house. One thing is sure, though, the coming years will be decisive to establish the right partnerships and secure the required share of the battery supply.

SNECI works closely with many EV battery players in Business Development, Strategy & Market Study, Partnership and M&A, and Industrial Project Management. Thanks to our global presence, we ensure commercial and industrial support to our clients worldwide, creating meaningful partnerships among suppliers, carmakers, and tech start-ups. Contact us now!