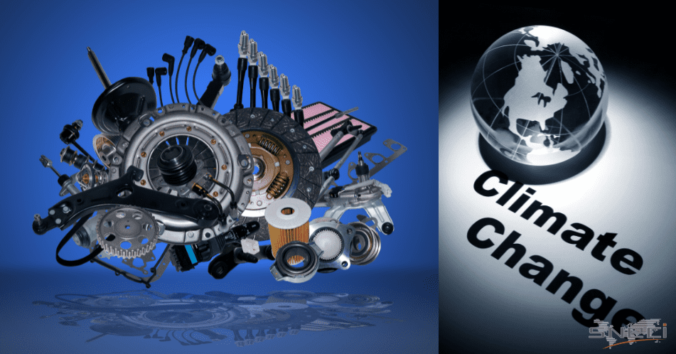

Spare parts & Climate Law Resilience or the end of the manufacturers’ monopoly

The Climate & Resilience Law enacted this summer in France marks the arrival of competition in visible automotive spare parts.

What does this mean? As of August 22, 2021, the Climate & Resilience Law puts an end to the historic monopoly of car manufacturers on spare parts by partially opening up competition in certain visible automotive spare parts.

What the Climate and Resilience Act says about opening spare parts to competition in the automotive industry:

The Climate and Resilience Law ended the historical monopoly of car manufacturers on spare parts. Article 32 of the law, published in the Journal Officiel on August 22, 2021, allows for a partial liberalization of mirrors and body parts, but a total opening of the market for glazing parts.

Indeed, with the Climate and Resilience Law, the deal changes. Now all OEMs, whether they are original equipment manufacturers or independent, have the possibility to market visible spare parts from January 1st, 2023.

This law provides that visible car parts, in other words, parts including fenders, hoods, bumpers, windshields or mirrors, which were until now protected in France under design and copyright law, thus allowing car manufacturers to be the only ones able to distribute parts to repairers, will be opened to competition.

Thus, the suppliers who manufactured the original part (or original equipment manufacturers) will be free to market the same spare part.

Regarding independent suppliers, they will have to wait 10 years after the registration of the design of the part before they can in turn produce and market this product. Previously, the law set this period at 25 years.

“We are satisfied because it is a liberalization during ten years to the benefit of the original equipment manufacturer, that is to say the one who has developed, designed and manufactured the part”, says the general manager of the Fiev.

The notion of other visible spare parts also includes glazing, so that the equipment manufacturers who have produced the original part will also be able to market it alongside the manufacturers.

This is a real revolution for the industry and marks the end of the car manufacturers’ monopoly on spare parts.

This opening of the spare parts market to competition should in principle bring down costs in order to support the purchasing power of the French.

At the same time, this new measure should also allow insurers to curb the continuous rise in costs that weighs on the insurance premium and therefore ultimately on the consumer.

For example, according to the SRA (Sécurité et réparation automobile), the professional organization to which car insurers belong, during the year 2020, the average cost of spare parts has increased by 5.9%, but the number of accidents has decreased.

To be noted that the reform is not only about car repair. The article of the law refers more broadly to “the reproduction, use and marketing of parts intended to restore the original appearance of a motor vehicle or trailer”.

What are the consequences for car manufacturers?

Why do we talk about a monopoly?

Initially, new parts are separated into two families.

On the one hand, we have the so-called “competitive” parts, which are mainly mechanical parts (shock absorbers, oil filters, brake pads, etc.) sold freely by manufacturers and equipment suppliers, and which alone represent 81% of the automotive spare parts market.

On the other hand, there are the so-called “captive” parts that appear on the outside of the vehicle, also called “visible car parts” and include fenders, hoods, bumpers, windshields, lights, mirrors, etc. These parts, which represent 19% of the French car spare parts market, are protected under design and copyright law.

Until now, manufacturers have had a legal monopoly on 70% of visible spare parts.

For the remaining 30%, manufacturers had a duopoly with equipment manufacturers. “Repairers are therefore required to obtain a significant portion of their needs from distributors in the manufacturer’s network,” explained the Competition Authority.

The news is not welcomed with opened arms by the car’s manufacturer:

While many car’s manufacturers are now practicing the policy of lower or stable prices, others have a heavier hand and are not playing the game, explains the SRA (AUTOMOTIVE SAFETY and REPAIR).

For example, in 2020, the cost of windshields increased a whopping 5.2% over 2019.

As a result, freeing up competition on glazing parts could have a positive impact on the glass claims burden.

With the COVID-19 crisis, the number of claims has dropped significantly, however, the average cost of claims has increased, notably with the rise in the cost of glass breakage due to the increasingly technological equipment.

The end of the monopoly for car’s manufacturers is not good news, in fact, they already indicated in 2011 that the end of the monopoly would threaten employment and result in a further decline in their operating profitability. “Although spare parts represent a limited share of the overall turnover of manufacturers, it should not be forgotten that they contribute, on the other hand, for a large part to their profitability,” recognizes the Competition Authority.

However, opening up to competition will help to boost the automotive industry. In Germany, for example, German manufacturers are subject to a completely liberalized market. To cope with this market evolution, they have adapted.

What consequences for automotive suppliers?

The Climate and Resilience Law should favor French OEMs (often small and medium-sized enterprises (SMEs)), which could obtain market share by producing quality parts with lower margins than carmakers or their partners.

However, in reality, this is not as easy as it seems. Indeed, car manufacturers often own the tooling used by OEMs to manufacture parts. This implies that OEMs are often bound by “tooling contracts” aimed at dissuading them from manufacturing parts to avoid marketing on their side.

“The fact of owning the tooling does not allow the manufacturer, under competition rules, to prohibit the OEM from using this tooling to produce parts for the aftermarket. The only thing he can do is ask the OEM to bear part of the cost of the tooling,” said Charles Aronica, FIEV’s General Manager.

For Erwann Kerguelen – Deputy General Reporter at the French Competition Authority – liberalization will not have an impact on contractual clauses. Indeed, if OEMs choose not to bear development costs (tooling or R&D) and transfer this financial risk to the manufacturer, it is potentially legitimate that the manufacturer benefits from additional rights. On the other hand, if the choice of this mode of financing is artificial and only serves to justify restrictions on the access of the OEM to the independent channel, this could pose a problem in terms of competition law.

Promote recycled parts: Encourage the development of reused parts

To reduce the cost of repair, one of the solutions proposed is to use reused parts, which come from the recycling of irreparable vehicles.

In general, these parts can be up to 60% cheaper than conventional parts.

Recycling parts has three advantages:

Ecological benefits:

- Preserve natural resources in raw materials

- Contribute to the improvement of the environmental footprint of vehicles throughout their life cycle

Economic benefits:

- Develop the reuse of used spare parts whose cost is lower than the price of new parts facilitates the repair of damaged vehicles and the maintenance of the vehicle fleet

- Develop the reuse of materials from ELVs for a second life in the automotive sector or any other sector

Societal benefits:

- Approved centers represent 17,000 direct jobs and thousands of indirect jobs generated by material shredding and recycling activities.

- Used spare parts facilitate the mobility of our fellow citizens.

But the recycling sector for the automotive industry in France is still underdeveloped, even though many companies already offer solutions.

“We need to encourage the dismantling of vehicles that are sold by insurers to recyclers. To build a real ecosystem, it is necessary that all insurers develop this field further”, explained Cédric Videau, head of the service providers division at Maif Assurance, which has invested in this sector for 10 years.

It should be noted that Article 30 of the Climate and Resilience Law stipulates that “Producers or their eco-organization shall ensure that these vehicles are taken back free of charge from private individuals at their place of ownership. This take-back is accompanied by a return premium, if it helps to increase the efficiency of the collection”.

At SNECI, as a member of the FIEV and concerned with accompanying automotive professionals towards green mobility, whether through the AUTOMOBILE SUPPORT PLAN or our other services, we offer both equipment carmakers and manufacturers solutions to improve industrial performance.

How do we do this? Through market studies, production transfer, sorting and reworking…

Our technical and specific skills have enabled us for nearly 70 years to offer solutions to automotive professionals that meet not only the regulations in force but also their needs.

Moreover, our 10 subsidiaries throughout the world and our 450 employees allow us to be locally agile, fast and efficient, guaranteeing the success and satisfaction of our customers.

The improvement of industrial performance depends above all on the people who make up the daily life of a company. At SNECI, people, training, digitalization, commitment, excellence and quality ensure that our customers’ expectations are more than met.