Impact of rising electricity prices in France on industries

France is preparing for a significant increase in electricity prices. What will be the impact of rising electricity prices?

The increase will take effect from February 1, 2024. Normal rates will rise by 8.6%, while off-peak/peak rates will increase by 9.8%. This government decision is part of the phasing out of the tariff shield. This shield had been introduced to mitigate the impact of international fluctuations in the electricity market. These fluctuations are often caused by geopolitical crises such as the war in Ukraine. This increase will have a major impact on French industries. They will have to face new challenges while exploring new energy supply opportunities.

Causes of rising electricity prices

Rising electricity prices in France are the result of a convergence of various interdependent factors. Firstly, the costs inherent in generating, transporting, and marketing electricity are fundamental. They contribute to the formation of final tariffs for consumers. These costs include investment in generation and distribution infrastructure, maintenance and upkeep, and power grid management. At the same time, taxes imposed on electricity, such as the domestic tax on final consumption of electricity (TICFE) and the contribution to the public electricity service (CSPE), also play a significant role in driving up prices. These taxes, intended to finance public initiatives such as the energy transition and the development of renewable energies, are integrated into electricity tariffs. They have a direct impact on consumers’ bills.

External factors

In addition, fluctuations in the electricity market, influenced by a multitude of economic, political, and geopolitical factors, exert further pressure on prices. Variations in supply and demand, changes in the energy mix, climatic conditions, as well as geopolitical events such as international tensions or geostrategic crises, can lead to major movements in electricity markets. These fluctuations are then reflected in the tariffs applied to industrial consumers. These fluctuations create an environment of uncertainty for businesses. They must constantly adapt to market changes to maintain their competitiveness and ensure their financial stability.

Electricity pricing is also closely linked to the amount of carbon emitted in its production. Within the European Union, energy producers are required to acquire CO2 emission rights to be able to release specific quantities of GHGs on the emissions trading market. This regulation aims to limit carbon emissions into the atmosphere by setting up a system for controlling and taxing pollutants. Thus, the more CO2 a power plant emits, the more emission allowances it is obliged to purchase. This has a direct impact on electricity production costs.

Changes in the price of CO2 emission allowances have a significant influence on the final price of electricity. Indeed, when the price of allowances rises, as was observed with an increase of more than 2.4 times between January 2021 and March 2023, this also has an impact on the cost of electricity production. This rise in production costs is then passed on to end-consumer tariffs. This contributes to higher electricity prices.

Geopolitical factors

Major geopolitical events, such as the Russian invasion of Ukraine, can also influence the price of CO2 emission allowances. In this context, market disruption and geopolitical uncertainties can lead to sudden and significant fluctuations in the price of carbon. This has an impact on electricity production costs and, consequently, on consumer tariffs.

Impact of rising electricity prices: consequences for industry

This increase in electricity prices represents a major financial challenge for French industries. This applies in particular to those industries that are highly energy-dependent. Companies operating in the manufacturing sector, for example, are likely to see a significant rise in their production costs. This could impact on their profit margins and international competitiveness. In this context, maintaining acceptable levels of profitability becomes a major concern for these industrial players. They need to consider rigorous cost optimization and energy management strategies. This will enable them to mitigate the financial impact of rising electricity prices.

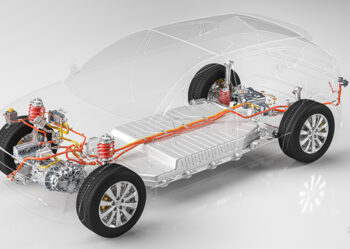

Similarly, sectors sensitive to electricity price fluctuations, such as the chemical, steel, and automotive industries, face additional challenges. These industries, which require large quantities of electricity for their operations, are particularly vulnerable to variations in energy costs. Faced with this reality, companies need to review their energy strategy. They also need to implement proactive measures to reduce their dependence on volatile electricity prices. For example, this could involve installing solar panels on warehouses or building wind farms close to production sites. This can include several actions such as adopting more energy-efficient technologies.

This may also involve seeking strategic partnerships with energy suppliers to ensure stable and competitive supplies. Ultimately, the ability of industries to adapt to this new energy landscape will determine their resilience and success in the global marketplace.

Challenges and opportunities for companies

In this new context, industrial companies need to explore innovative solutions to optimize their energy consumption. Improving energy efficiency is a major priority for companies. This approach offers them the opportunity to reduce their energy footprint while minimizing their costs. This can be achieved in several ways. First, the adoption of state-of-the-art technologies is essential. Secondly, the implementation of advanced engineering practices is necessary. These actions aim to optimize production processes and limit energy losses.

At the same time, investment in alternative and renewable energy sources is a promising strategy for companies. They are looking to diversify their electricity supplies. By harnessing the potential of solar, wind and geothermal energy, companies can reduce their dependence on volatile electricity prices. What’s more, they strengthen their resilience in the face of market fluctuations.

In addition, careful management of electricity supply contracts is crucial to companies’ long-term financial stability. Supplier diversification is a key strategy for companies. In addition, the use of fixed-price contracts over the medium or long term and the implementation of risk management mechanisms are essential practices. They enable companies to protect themselves against the adverse effects of price volatility on their profitability. By anticipating market fluctuations, companies can better control their energy costs. And by adopting informed procurement strategies, they can ensure their competitiveness in the marketplace.

Conclusion

In conclusion, rising electricity tariffs in France represent a major challenge for industry. However, it also opens up new opportunities for innovation and transformation. Companies need to adopt a proactive and strategic approach to this economic reality, to meet the challenges associated with rising electricity prices. By investing in energy efficiency, companies can mitigate the financial impact of rising rates. In addition, by diversifying their energy sources and optimizing their supply contracts, they can strengthen their competitiveness on the international stage.

This period of energy transition is an opportunity for businesses. They can play a leading role in building a more sustainable and energy-resilient economy.